Explore Liquidity Mining

Start mining liquidity over multiple blockchains using a single asset. No extra fee.

Pools

|

TVL

|

Daily

|

apy

|

|---|---|---|---|

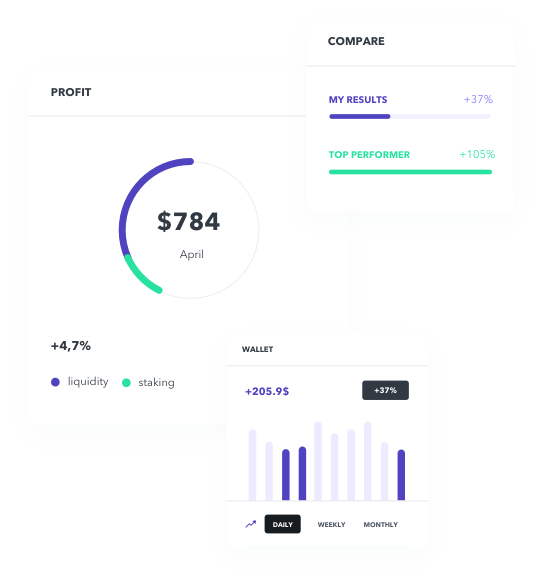

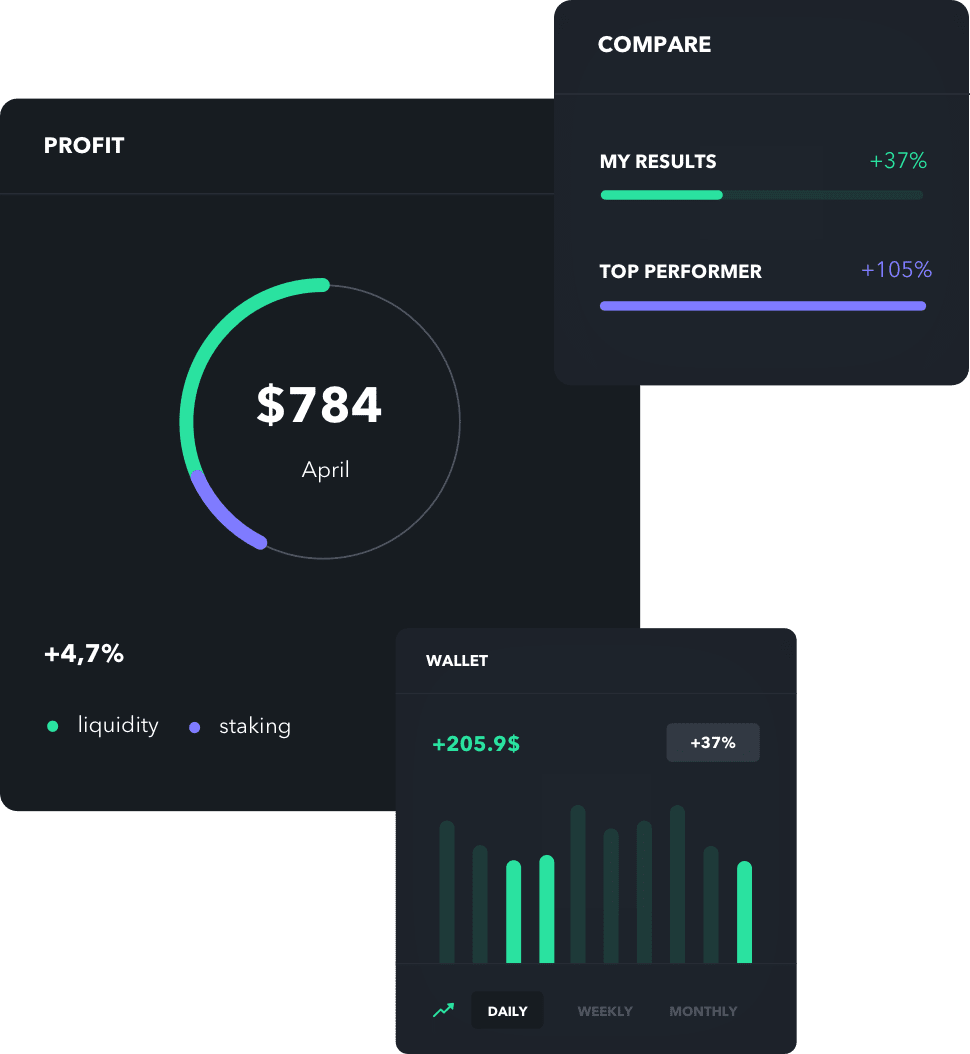

Access DeFi

from a single Interface

End-to-end solution to build and manage one or multiple DeFi portfolio(s) from one place. Discover the world of decentralized finance with EGG.

Open Dashboard

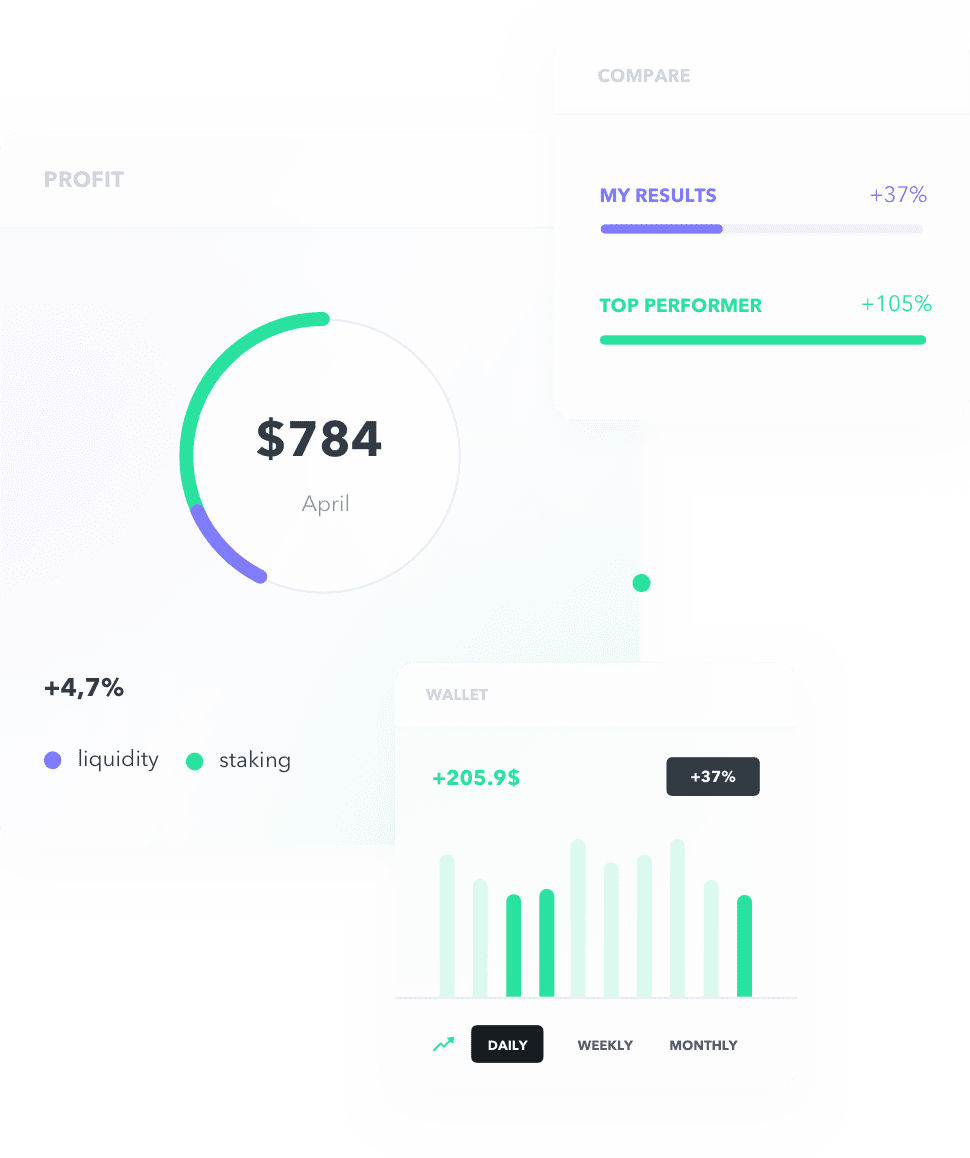

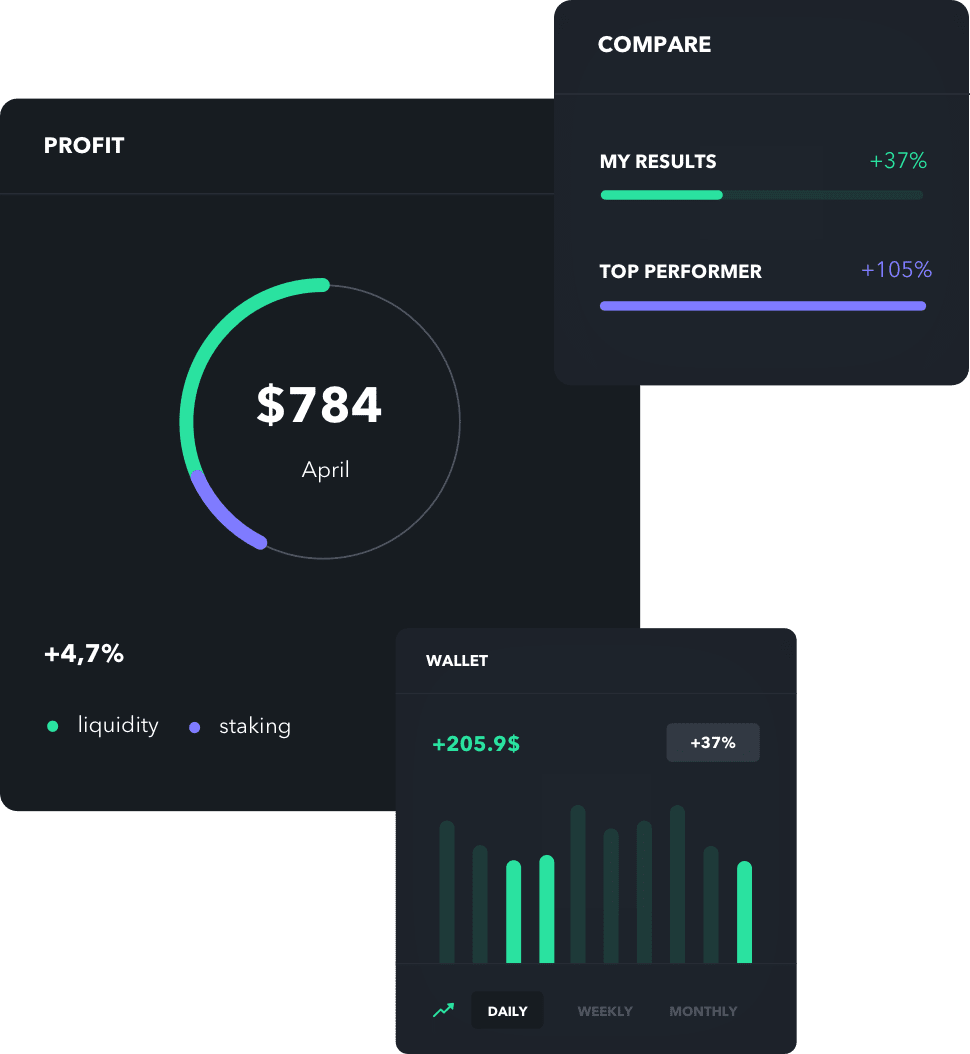

Copy Top Performers

Decentralized asset management protocol connecting you with the world’s best portfolios on the Ethereum blockchain in a permissionless, non-custodial and trustless manner.

Open Dashboard

Multi-Chain

DeFi Simplified

Gain smart DeFi access with interoperability across multiple blockchain ecosystems. EGG Protocol integrates with DeFi from Ethereum, Polkadot, Binance Smart Chain, Solana, Cardano and Tron.

Open DashboardDeFi Liquidity Mining Platform FAQs

If you have more questions, contact us

Contact

English

English